Why Affordable Housing in Chicago IL Matters More Than Ever

Finding affordable housing in chicago il has become one of the biggest challenges facing residents today. With over 324,000 affordable rental homes missing from the market for extremely low-income households statewide, Chicago's housing crisis impacts everyone from young professionals to seniors on fixed incomes.

Quick Answer - Top Affordable Housing Options in Chicago:

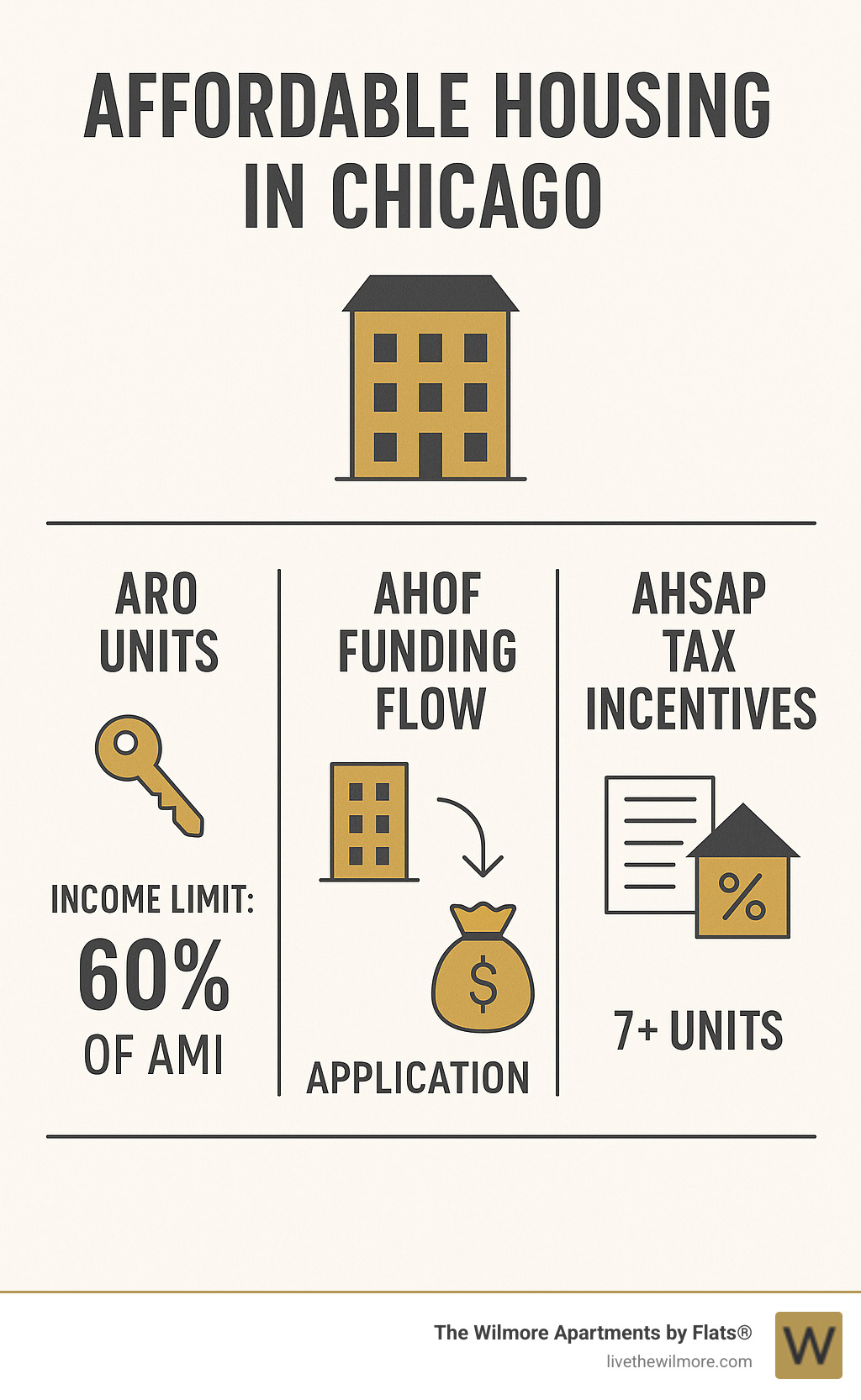

- Affordable Requirements Ordinance (ARO) - Income-restricted units in new developments (60% AMI limit)

- Chicago Housing Authority (CHA) - Section 8 vouchers and public housing with open waitlists

- Affordable Housing Opportunity Fund (AHOF) - 2,700+ units created across 31 developments citywide

- Cook County AHSAP Program - Tax-incentivized affordable units (7+ unit minimum)

- Supportive Housing - Income-based rent with on-site services for special needs populations

The numbers tell a stark story. Chicago households earning around $12,540 annually - the average income of residents in affordable housing programs - face impossible choices between rent, food, and healthcare. This isn't just about individual hardship. When people spend more than 30% of their income on housing, entire neighborhoods suffer from reduced economic activity and community instability.

But there's hope. The city has responded with creative solutions that go beyond traditional public housing. Through programs like the Affordable Requirements Ordinance, new luxury developments must include income-restricted units or pay fees that fund affordable housing elsewhere. Meanwhile, the Affordable Housing Opportunity Fund has already created or preserved over 2,700 rental units, proving that public-private partnerships can work.

The challenge now is navigation. With multiple programs, varying income limits, and complex application processes, finding the right affordable housing option requires understanding how these systems actually work.

The Urgency of Affordable Housing in Chicago

Chicago's housing crisis runs deeper than most people realize. The city faces a shortage of 324,000 affordable rental homes for extremely low-income households statewide - a gap so massive it affects every neighborhood and every income level. While the Affordable Housing Opportunity Fund has made real progress by creating and preserving 2,700 units across 31 developments, this represents just a small dent in the overwhelming need.

The ripple effects touch every aspect of daily life. When families spend more than 30% of their income on rent - a reality for thousands of Chicago residents - the consequences extend far beyond housing costs. Children in rent-burdened households move frequently, disrupting their education and friendships. Parents skip doctor visits to make rent payments. Grandparents on fixed incomes face impossible choices between medication and keeping a roof over their heads.

But this isn't just about individual hardship. The housing shortage is quietly reshaping Chicago's economic landscape in ways that affect everyone. When teachers, nurses, and service workers can't afford to live near their jobs, entire industries struggle to maintain stable workforces. Local businesses lose customers, and public services suffer from high turnover.

The preservation challenge adds another layer of urgency. Many existing affordable units are at risk of converting to market rate as their affordability periods expire. This means Chicago isn't just racing to build new affordable housing in chicago il - it's also fighting to keep the affordable units it already has.

Why It Matters for Residents & the City

The housing crisis creates a domino effect that reaches every corner of Chicago's economy. When cost-of-living pressures force families to spend excessive amounts on rent, they have little left for education, job training, or starting small businesses. This cycle keeps people trapped in economic situations that are hard to escape.

Economic mobility depends heavily on housing stability. Families who aren't constantly worried about rent can invest in their children's education, pursue better job opportunities, or save for emergencies. Affordable housing programs create this breathing room - the difference between surviving month to month and actually building a better future.

The city benefits tremendously from mixed-income communities that programs like ARO help create. When affordable units are integrated into market-rate developments, residents gain access to better schools, improved public services, and more economic opportunities. These neighborhoods tend to be more resilient, with stronger social networks and less economic segregation.

Chicago's workforce stability also depends on affordable housing. Hospitals need nurses who can afford to live nearby. Schools need teachers who don't face hour-long commutes. Restaurants need servers who can get to work without spending their entire paycheck on transportation. When these workers can't afford housing, the entire service economy suffers.

Key Numbers That Define the Crisis

The math behind Chicago's housing crisis tells a stark story. The city's Low Income Housing Trust Fund currently provides annual rent subsidies to approximately 2,700 low-income residents, but demand far exceeds this supply. For perspective, that's roughly the population of a small neighborhood trying to serve the needs of hundreds of thousands.

Income-to-rent ratios reveal the depth of the challenge. Affordable units in Cook County programs must be rented to households earning at or below 60% of the area median income (AMI). For a studio apartment, this means a maximum income of $47,100 for one person or $53,820 for two people. Rent cannot exceed 30% of these income thresholds.

The subsidy reach remains limited despite ongoing efforts. Even qualifying for affordable housing doesn't guarantee immediate access. Waitlists are common, and many programs operate on first-come, first-served basis that rewards those who can steer complex application processes quickly.

Here's what the current landscape looks like: Chicago has created thousands of affordable units through various programs, but the need continues to outpace supply. The gap between average market rents and what low-income households can afford continues to widen, making programs like ARO and AHOF increasingly important for maintaining housing diversity across the city.

Affordable Housing in Chicago IL: Programs, Incentives & Ordinances

Chicago tackles its housing crisis through a thoughtful mix of programs designed to work together. Think of it as a toolkit where each program serves a specific purpose - some help renters find affordable homes, others encourage developers to build them, and still others provide the funding to make it all happen.

The city's Department of Housing has a straightforward mission: expand access and choice for residents while protecting their right to quality homes that are affordable housing in chicago il, safe, and healthy. This isn't just bureaucratic language - it translates into real programs that create thousands of affordable units across the city.

For renters, the main pathways include the Affordable Requirements Ordinance (ARO), which creates income-restricted units in shiny new developments, and the Chicago Housing Authority's Section 8 voucher program. For property owners, there are tax incentives through Cook County's Affordable Housing Special Assessment Program (AHSAP) and various funding opportunities through the Affordable Housing Opportunity Fund.

The beauty of this system is that it doesn't rely on just one approach. Instead, it creates multiple entry points for both renters and developers, increasing the chances that affordable housing actually gets built and filled.

More info about Affordable Homes provides additional details about how these programs work in practice, including eligibility requirements and application processes. You can also find detailed Income & Rent Limits that help determine if you qualify for these programs.

Affordable Housing Special Assessment Program (AHSAP)

Cook County's AHSAP program offers property owners a compelling deal: significant tax reductions in exchange for creating affordable housing. The math is simple - lower property taxes mean developers can afford to charge lower rents while still making their projects work financially.

The program requires a minimum of seven units (with exceptions for special income-based subsidy programs) and offers assessment reduction tiers that vary by location and project type. Properties in low-affordability communities can receive up to 35% assessment reductions, while standard projects typically see 15-20% reductions.

Getting into the program involves a two-part application process. Part 1 costs $500 and must be submitted before the property goes into service, while Part 2 costs $100 and gets filed after qualifying tenants move in. The program defines "in-service date" as when affordable units are actually occupied by qualifying tenants and all required construction is completed.

The commitment is ongoing. Properties must maintain affordability for the duration of their participation, with annual affidavits required to demonstrate compliance. The reduction applies not only to buildings but also to adjacent land used exclusively by residents, such as parking lots.

Mixed-use properties can receive full reduction if at least 65% of net rentable area is residential. If more than 35% is non-residential, only the residential portion qualifies for the tax reduction.

Affordable Requirements Ordinance (ARO)

The ARO represents Chicago's most creative approach to ensuring that new development benefits everyone, not just high-income residents. The ordinance requires new residential developments of a certain size to either include affordable units on-site or pay in-lieu fees that fund affordable housing elsewhere in the city.

This creates a win-win scenario. Developers who want to include affordable units can do so, creating mixed-income communities. Those who prefer to pay fees instead help fund affordable housing in other neighborhoods where it might be more needed.

When units are included on-site, they must offer comparable amenities to market-rate units within the same development. This means affordable housing residents get access to the same fitness centers, rooftop decks, and other building features as their market-rate neighbors.

The program targets households at 60% of Area Median Income, with specific thresholds varying by household size. ARO units are typically awarded on a first-come, first-served basis, making early application crucial for prospective residents.

The city enforces ARO requirements through its Department of Housing, requiring developers to submit compliance plans and documentation. Non-compliance can result in penalties or additional fees, creating strong incentives for developer participation.

Affordable Housing Opportunity Fund (AHOF) & Other City Funds

The AHOF serves as the financial engine behind Chicago's affordable housing efforts. Funded primarily by in-lieu fees from developers under the ARO, the fund has supported 31 developments citywide to create or preserve more than 2,700 affordable rental units.

The fund operates on a smart dual approach: half of AHOF money goes to construction, rehabilitation, or preservation of units, while the other half funds rent subsidies through the Chicago Low Income Housing Trust Fund. This balanced approach addresses both the need for new affordable housing and the ongoing challenge of keeping existing units affordable.

AHOF supports multiple targeted programs, including the Opportunity Investment Fund, Preservation of Existing Affordable Rental (PEAR), Micro-Market Recovery Program, and Building Neighborhoods and Affordable Homes initiative. Each program addresses specific aspects of the affordable housing challenge, from preventing displacement to revitalizing underinvested neighborhoods.

The fund also supports supportive housing programs that combine affordable units with on-site services for residents with special needs. These programs recognize that housing stability alone isn't enough for some residents - they also need access to mental health services, job training, or other support services.

Qualifying & Applying: Your Roadmap to Affordable Housing

Let's be honest - applying for affordable housing in chicago il can feel overwhelming at first. But once you understand the basics, it's actually pretty straightforward. Most programs use similar income rules and paperwork, which means you can apply to multiple opportunities without starting from scratch each time.

The magic number you need to know is 60% of Area Median Income (AMI). This is the income limit for most affordable housing programs in Chicago. Think of it as the golden ticket - if your household income falls at or below this threshold, you're likely eligible for affordable housing options throughout the city.

Getting your paperwork organized early makes everything easier. Most programs want to see the same basic documents: recent pay stubs, tax returns, bank statements, and proof of any government benefits you receive. Having these ready to go can be the difference between snagging an affordable unit and missing out to someone who applied faster.

More info about FAQs answers many common questions about the application process and can help you avoid typical mistakes that slow down approvals.

Income & Rent Limits for Affordable Housing in Chicago IL

The income limits for affordable housing in chicago il are refreshingly clear once you know how they work. For 2024, a single person can earn up to $47,100 annually and still qualify for most programs. If you're a couple, that limit jumps to $53,820. Three-person households can earn up to $60,540 and still access affordable housing options.

These aren't just random numbers - they directly determine how much rent you'll pay. Affordable housing units can't charge more than 30% of your qualifying income level. This built-in protection ensures you won't become rent-burdened, even if your income fluctuates slightly.

Here Income & Rent Limits provides the complete breakdown for all household sizes and program types.

Housing Choice Vouchers work differently from other programs. Instead of income-restricted units, vouchers let you rent any participating property. The voucher covers the gap between 30% of your income and the actual rent, up to limits set by the Chicago Housing Authority.

Some programs get creative with income averaging. This means if some units serve households earning less than 60% AMI, others can serve slightly higher incomes as long as the overall average meets program requirements. It's a flexibility that helps more families access affordable housing.

How Renters Apply and Secure a Unit

The application process varies depending on which program you're targeting, but there are common patterns that make it easier to understand. For ARO units in new developments, you typically apply directly through the property management company or developer. These applications usually work on a first-come, first-served basis, so timing really matters.

Chicago Housing Authority programs, including Section 8 vouchers, use centralized waitlists. When these waitlists open - which doesn't happen often - you can apply online through the CHA website. Fair warning: when waitlists do open, thousands of people apply within hours. The authority uses a lottery system to determine placement when applications exceed available spots.

Supportive housing programs require additional screening to match services with resident needs. These programs combine affordable housing with on-site support for people with disabilities, veterans, or those experiencing homelessness. The extra screening ensures you'll get the specific support services you need.

Documentation requirements are pretty standard across programs. You'll need proof of income for everyone in your household over 18, recent bank statements, identification, and Social Security cards. Some specialized programs ask for additional paperwork like disability verification or proof of veteran status.

The key to success is staying organized and applying quickly when opportunities arise. Many successful applicants keep their documents in a dedicated folder (physical or digital) so they can respond immediately when applications open.

How Property Owners Tap Into Incentives

Property owners interested in affordable housing incentives need to understand that each program has its own application timeline and requirements. The AHSAP program, for example, requires careful coordination between two application parts. Part 1 must be submitted before your property goes into service, while Part 2 gets filed after qualifying tenants move in.

The application fees are straightforward: $500 for Part 1 and $100 for Part 2. You'll receive invoices after submission, and payment must be received before processing begins. The program uses DocuSign for electronic submissions, which speeds up the process considerably.

Annual compliance is where many property owners stumble. You'll need to file annual affidavits documenting ongoing compliance with affordability requirements. These aren't just paperwork exercises - properties must maintain building code compliance and provide evidence of proper maintenance and safety standards.

Project labor agreements may be required for properties in low-affordability communities. While this adds another compliance layer, it can also increase your available tax reduction tier, making the extra effort worthwhile.

The DocuSign system makes submissions much easier than traditional paper filing, but you still need to plan ahead. Processing times vary, and you don't want to miss deadlines that could affect your tax benefits or program participation.

Resources, Challenges & Recent Updates

Finding affordable housing in chicago il has gotten easier thanks to new digital tools, but the system still faces real challenges that affect everyone looking for an affordable place to call home. The good news? Chicago maintains a public data portal that lists affordable rental housing developments, so you can see exactly where opportunities exist across the city.

Recent policy updates show the city is paying attention to changing economic conditions. The 2024 AMI updates bumped up income thresholds slightly, meaning more households can now qualify for affordable housing programs. It's a small step, but it helps when every dollar counts.

The reality check? Construction costs keep climbing, and some neighborhoods still push back against new affordable housing developments. Rising material and labor costs make it genuinely harder to build affordable units, while political resistance in certain communities creates roadblocks that slow down progress.

Digital Search Power-Ups & Support Services

Technology has completely changed the affordable housing search game. The Illinois Housing Development Authority's Housing Search Locator now offers mapping features and advanced search criteria that actually make sense. You can filter by what matters most to you - whether that's accessibility features, pet policies, or specific income restrictions.

ILhousingsearch.org provides a free online service created by several state housing agencies. It's comprehensive, user-friendly, and doesn't try to sell you anything. The platform includes all the filters you'd expect, plus some you might not have thought of.

Chicago's open data portal takes transparency seriously. You can explore current affordable rental housing developments with detailed information about unit counts, contact information, and program types. No more guessing games about what's actually available.

Housing Counseling Centers throughout the city provide free assistance with application processes, credit counseling, and housing search strategies. These services are especially valuable if you're new to affordable housing programs or just need someone to walk you through the process.

When you need help, these numbers actually connect you to real people: Chicago Housing Authority at 312-742-8500, Department of Housing at 312-744-3653, Illinois Housing Development Authority at 312-836-5200, and Fair Housing hotlines for discrimination complaints.

Policy Shifts & Ongoing Challenges

Recent policy changes show the city is trying to balance affordable housing creation with fiscal responsibility. In-lieu fee adjustments ensure that developers contribute fairly to affordable housing funds while keeping incentives for actually building units on-site.

The ongoing debate between preservation and new construction continues to challenge policymakers. Preserving existing affordable units often costs less than building new ones, but preservation alone can't address the massive scale of current need. It's a classic "both/and" situation rather than "either/or."

Neighborhood resistance to affordable housing remains frustrating, despite solid research showing that well-managed affordable housing doesn't hurt property values. Community education and engagement efforts are ongoing, but changing minds takes time.

Zoning changes and streamlined approval processes are being considered to reduce development costs and timelines. These reforms could significantly boost affordable housing production if they actually get implemented effectively.

Frequently Asked Questions about Affordable Housing in Chicago IL

1. What documents prove I meet 60% AMI requirements? You'll need recent pay stubs (typically 2-3 months), tax returns from the previous year, bank statements, and verification of any government benefits. Self-employed individuals may need additional documentation like profit and loss statements. It sounds like a lot, but most people already have these documents.

2. Do Housing Choice Vouchers count toward affordability quotas? Yes, units occupied by voucher holders typically count as affordable units for program compliance purposes. This creates real opportunities for voucher holders to access units in mixed-income developments, which is great news for expanding your housing options.

3. How does the city ensure units remain safe and code-compliant? The city requires ongoing compliance documentation, including building code certificates and annual affidavits. Properties participating in affordable housing programs face regular inspections and must maintain safety standards equivalent to market-rate units. Nobody gets a pass on basic safety and maintenance.

Other common questions include eligibility for multiple programs simultaneously (generally allowed), waitlist procedures (varies by program), and what happens if income changes after moving in (most programs allow reasonable increases but require annual recertification).

Conclusion

Finding affordable housing in chicago il doesn't have to feel like searching for a needle in a haystack. While the system has its complexities, Chicago offers real opportunities for quality housing at prices that won't break the bank. From ARO units tucked into luxury developments to supportive housing with wraparound services, there's likely a program that fits your situation.

The secret sauce? Start early and cast a wide net. Most programs work on a first-come, first-served basis or use lottery systems, so applying to multiple opportunities gives you the best shot at success. Don't let waitlists discourage you - people move, circumstances change, and new opportunities open up regularly.

Here at The Wilmore Apartments by Flats®, we've seen how affordable housing can blend seamlessly with luxury living. Our ARO units in Uptown prove that you don't have to sacrifice style for affordability. Every resident - regardless of income level - enjoys the same stunning amenities, modern design, and prime location that makes our community special.

The future looks bright for affordable housing in Chicago. Creative programs like ARO are showing that everyone wins when developers, residents, and neighborhoods work together to create truly mixed-income communities. It's not just about providing cheaper rent - it's about building stronger, more diverse neighborhoods where everyone can thrive.

Ready to take the next step? The path to affordable housing starts with understanding your options and getting those applications in motion. More info about affordable-homes can walk you through eligibility requirements and help you steer the application process. Whether you're eyeing ARO units, applying for housing vouchers, or exploring supportive housing options, your affordable home in Chicago is out there waiting for you.